Small Business Vehicle Finance in Australia: A Guide for Small Businesses

Vehicles are vital tools for many Australian small businesses. Plumbers, electricians, couriers, landscapers and mobile service providers rely on utes, vans and trucks to transport tools, materials and staff to job sites. Tradespeople need to move heavy equipment between worksites, delivery companies need refrigerated trucks and vans to keep goods cold, and consultants often need a reliable car for client meetings. Owning or leasing the right vehicle improves productivity, enhances customer service and can open new business opportunities. Financing those vehicles efficiently is therefore a key part of managing a small business.

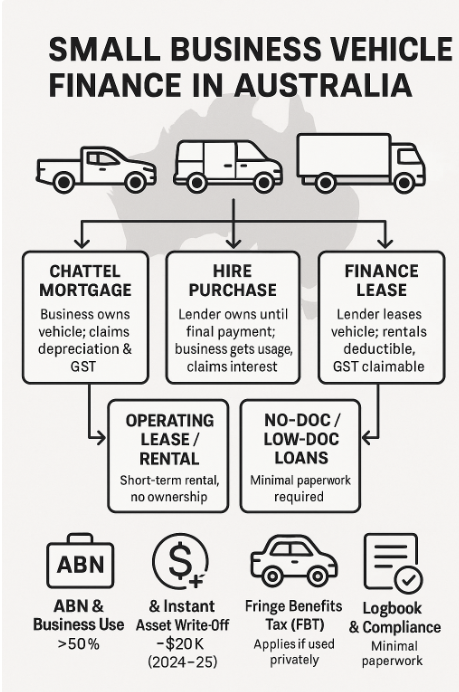

Australia offers a range of financing options for business vehicles, but navigating the terminology and legal requirements can be daunting. This article provides a detailed overview of small‑business car and truck loans in Australia, including low‑doc and no‑doc loans designed for self‑employed people who may not have complete financial statements. It also covers loan structures such as chattel mortgages and hire purchase, explores tax issues like Goods and Services Tax (GST) credits and Fringe Benefits Tax (FBT), and outlines legal considerations.

Throughout this guide, the term business vehicle means a car, ute, van, truck or other vehicle used primarily for business purposes. The Australian Taxation Office (ATO) regards a vehicle as being used primarily for business if more than 50 % of its use is business‑related. Vehicles used mainly for private purposes fall under consumer credit rules and are not covered by the flexible business‑finance options discussed here.

Overview of Business Vehicle Finance

What makes a loan “business” finance?

Australia’s National Consumer Credit Protection Act 2009 (NCCP) and the National Credit Code (NCC) regulate loans for personal, household or domestic purposes. These laws require lenders to be licensed and to make inquiries to ensure consumer loans are suitable and affordable. However, the NCC does not apply if credit is provided wholly or predominantly for business purposes. The South Australian Law Handbook explains that if more than half of the credit will be used for business, the NCC does not apply. The Financial Rights Legal Centre similarly notes that loans for business leases or business loans are usually excluded from the National Credit Act. This distinction means business‑purpose loans are not subject to the same responsible‑lending obligations, and lenders can offer products that require fewer documents or provide more flexible terms.

Because the NCC does not apply, borrowers often sign a business purpose declaration acknowledging that the loan will be used for business or investment and that consumer protections will not apply. The declaration must be in a form prescribed by regulation and must warn the borrower that the protections of the NCC may be lost. Borrowers should only sign such declarations if they genuinely intend to use the loan for business; the Law Handbook warns that unscrupulous lenders sometimes coerce consumers into signing to avoid compliance.

General eligibility for business vehicle finance

Most lenders require applicants for business vehicle finance to meet certain basic criteria:

- Hold an Australian Business Number (ABN). Business loans are generally available only to registered businesses (sole traders, partnerships, trusts or companies).

- Use the vehicle primarily for business. The vehicle must contribute to generating income. The ATO expects that more than half of the vehicle’s use must be for business purposes. Commuting between home and a regular workplace is not considered business use.

- Provide proof of income. Lenders will require some evidence of ability to repay. For low‑doc and no‑doc loans this may be minimal (see Section 4), but full‑doc loans require complete financial statements.

- Be an Australian citizen or permanent resident and hold a valid driver’s licence.

Some lenders also require borrowers to be GST‑registered. Many low‑doc and no‑doc products stipulate that the business must have been operating for at least 12 months and that the borrower owns property or can provide a deposit (often 10‑20 %), especially for new businesses.

Loan structures

Small businesses can access several different loan structures to finance a vehicle. The main structures are:

- Chattel mortgage (equipment loan). The business takes ownership of the vehicle upfront and the lender registers a security interest (mortgage) over the asset. The business can claim depreciation, interest and running costs, and may be eligible for the instant asset write‑off and GST input‑tax credits. Chattel mortgages are often used for both cars and trucks. At the end of the loan term the mortgage is discharged and the business owns the vehicle outright.

- Hire purchase. The lender owns the vehicle until the final payment is made; the business pays instalments and uses the vehicle during the term. Ownership transfers to the business after the last payment. Businesses may claim depreciation and interest but not the GST on the purchase price (GST is claimed on each instalment).

- Finance lease. The lender purchases the vehicle and leases it to the business. The vehicle remains the lender’s property, and the business pays lease rentals. Rental payments are tax‑deductible and GST credits can be claimed on each rental. At the end of the lease the business may have an option to purchase the vehicle at residual value or upgrade.

- Operating lease / rental agreements. The business pays for the use of the vehicle without any ownership rights. At the end of the lease the vehicle is returned. This is common for heavy machinery or where vehicles need regular upgrading.

Novated leases (a type of salary‑packaging arrangement) are discussed later in the tax section because they give rise to fringe benefits tax.

Low‑Doc and No‑Doc Car Loans

Why low‑doc and no‑doc?

Traditional business loans generally require borrowers to provide detailed financial statements, tax returns and other evidence of income. Many self‑employed people or small businesses do not have recent financial statements or may have irregular income streams. Low‑doc and no‑doc loans fill this gap by allowing borrowers to secure finance with less documentation. They are particularly popular with sole traders, contractors and tradespeople who may have strong cash flow but limited paperwork.

Features of no‑doc car loans

A no‑doc car loan requires minimal financial documentation. AAA Finance explains that businesses do not need to provide financial statements or tax returns, but must:

- Provide an estimate of net turnover and gross profit.

- Sign a declaration confirming their ability to repay the loan.

- Be GST‑registered and have a business that has been operating for several years.

- The individual must own property to qualify.

Such loans suit established businesses with strong cash flow but incomplete accounts. Interest rates may be higher than for full‑doc loans, and lenders may require a deposit or collateral, such as property or a trade‑in. BizWitty notes that property owners may not need a deposit, while non‑property owners may need to contribute 10‑20 %. Tax returns are generally not required for car loans under $150 000 or truck finance under $250 000.

Features of low‑doc car loans

A low‑doc car loan requires some documentation but not full financial statements. According to AAA Finance, acceptable documents include:

- Business Activity Statements (BAS).

- Profit and Loss statements.

- Bank statements.

- An accountant’s letter confirming projected earnings.

These documents demonstrate revenue flow through the business and assure lenders of the borrower’s capacity to repay. The borrower may still need to sign an income declaration. AAA Finance notes that low‑doc loans are available in loan terms from 1 to 7 years and may include a balloon payment option to reduce monthly repayments.

Broker.com.au reports that low‑doc car loans typically range from $5 000 to $100 000, with loan terms of 2–8 years and interest rates between 5 % and 10 % per annum. The main advantage is the ability to finance a vehicle without providing complete income documents; however borrowers pay higher interest rates and may incur early‑repayment fees. Applicants should hold an ABN and may need to sign an income declaration.

Deposit requirements and property ownership

Many low‑doc lenders assess risk partly on whether the borrower owns property. Patterson Cheney Trucks (an Isuzu dealership) explains that their low‑doc truck and equipment loans require borrowers to have been trading for two years or more and either be a homeowner or provide a 20 % deposit. For “Easy Finance” with no financials, applicants must either own a home or submit a 20 % deposit and have at least two years’ transport‑industry experience. QPF Finance, a truck broker, notes that financing a new venture is possible without a deposit for individuals with substantial industry experience, but in most cases a 20 % deposit is required. They also state that truck finance may be available without a deposit for established businesses with good credit.

For car loans, BizWitty similarly notes that self‑employed borrowers who do not own property may need a 10–20 % deposit, while property owners might secure finance with no deposit. Borrowers should anticipate that lenders will request evidence of property ownership or deposit funds to reduce risk.

Loan terms and interest rates

Loan terms vary by lender and loan type. AAA Finance offers business vehicle loan terms from one to seven years. QPF states that the average truck loan term is five years, although borrowers can select shorter or longer periods. Truck finance FAQs on AAA Finance’s site also confirm that truck loan terms extend from 1 to 7 years.

Interest rates depend on factors such as the borrower’s credit profile, the age and type of vehicle and the loan term. QPF advertises truck finance rates from 6.95 %. Broker.com.au lists low‑doc car loan rates between 5 % and 10 %. AAA Finance explains that truck finance rates depend on previous credit history, loan amount and the age and type of truck. Borrowers with weaker credit or start‑up businesses may face higher rates.

No‑Doc and Low‑Doc Truck Loans

No‑doc truck finance

No‑doc truck loans are similar to no‑doc car loans but tailored to larger vehicles. AAA Finance describes them as chattel mortgages for ABN holders where the truck being purchased serves as security for the loan. Borrowers do not need to supply financial statements or tax returns but must sign an income declaration. Minimum requirements include:

- The business must be registered for GST.

- The business should be operating for more than two years.

- Directors or proprietors should be asset‑backed.

No‑doc truck loans are well suited for established operators who may have irregular documentation but strong income. AAA Finance also notes that their brokers have access to over 40 lenders and can secure approvals within 24 hours for many truck loans.

Low‑doc truck finance

Low‑doc truck loans require minimal documentation. AAA Finance states that borrowers can supply interim financials or documentation from accounting software such as MYOB or Xero. Acceptable documents include:

- Business Activity Statements;

- Three months of bank statements;

- A profit and loss statement;

- An accountant’s letter.

The Low‑Doc home‑loan guidelines from Patterson Cheney Trucks specify that applicants must have traded for two years or more and either be homeowners or provide a 20 % deposit. For no‑financials “Easy Finance”, applicants must be homeowners or contribute a 20 % deposit and have at least two years’ transport‑industry experience. These conditions illustrate the importance of experience and collateral in obtaining low‑doc truck finance.

Full‑doc truck loans

Full‑doc loans require up‑to‑date financial statements, including a tax return for the business, profit and loss statement and/or balance sheet. These loans typically offer the lowest interest rates because the lender has a clear picture of the borrower’s finances and risk. They are suitable for newer businesses that lack property assets or for borrowers who prefer to provide full documentation to secure better terms.

Pre‑approval and brokers

AAA Finance emphasises the benefits of obtaining pre‑approval for truck finance. Pre‑approval provides an amount of funds available for a particular asset class and can give borrowers negotiating power when purchasing at auction or from a dealer. The company also explains that experienced finance brokers understand each lender’s requirements and can match borrowers with the lender offering the best terms. Access to a broad panel of lenders (over 40 in AAA’s case) is a key advantage of using a broker. Truck finance FAQs on AAA’s site underscore that consulting a finance broker is “the easiest and most effective way” to secure a great deal.

Full‑Doc Business Vehicle Loans

Businesses that can provide complete and up‑to‑date financial statements may prefer full‑doc loans. AAA Finance explains that full‑doc car loans require:

- Financial statements for companies;

- Personal tax returns and Notices of Assessment for sole traders.

Full‑doc loans may be necessary for businesses that have been operating for a short time, are not GST‑registered or are not asset‑backed. Because lenders can thoroughly assess the borrower’s finances, these loans tend to attract the most competitive interest rates.

Legal and Regulatory Considerations

National Credit Code and business purpose declarations

As noted earlier, the National Credit Code (NCC) generally applies to loans for personal, household or domestic purposes. Loans provided wholly or predominantly for business purposes or for investment (other than residential property) are excluded. The Financial Rights Legal Centre lists business leases or business loans among the types of credit contracts that the National Credit Act does not usually cover. Consequently, lenders offering business vehicle loans are not bound by some consumer protections (such as mandatory suitability assessments) and can adopt streamlined approval processes.

However, if a loan is part personal and part business use, or if the borrower intends to use more than half the credit for personal use, the NCC applies. Borrowers may be asked to sign a business purpose declaration confirming that the credit will not be used for personal purposes. The Law Handbook warns that such declarations must be in the prescribed form and must caution borrowers that the protections of the NCC may be lost. Lenders that coerce consumers into signing a declaration when the loan is actually for personal use may commit an offence.

Although business loans fall outside the NCC, lenders must still comply with other laws, including the Australian Consumer Law (which prohibits misleading or unconscionable conduct) and the ASIC Act (which prohibits harassment during debt collection). Responsible lending practices and credit licensing under the NCCP do not apply, so borrowers should exercise due diligence and consider seeking independent financial advice.

Consumer law protections for business purchases

Buying a vehicle as a business affects consumer law protections. The Western Australian Small Business Development Corporation (SBDC) notes that when a business buys a vehicle, the Australian Consumer Law (ACL) applies only if the vehicle costs less than $100 000 or is mainly used to transport goods on public roads. Consumer guarantees (such as acceptable quality and fitness for purpose) apply only when purchasing from a car dealership, not from private sellers. When buying privately, the onus is on the business to ensure the vehicle is roadworthy and free of encumbrances.

Taxation of business vehicles

Goods and Services Tax (GST)

Businesses registered for GST can claim a credit for the GST included in the purchase price of a motor vehicle when it is used solely for business and they hold a tax invoice. If the vehicle is used partly for business and partly for personal use, the business can claim a credit only for the business‑use portion. There is a car depreciation limit that caps the GST credit; for 2025–26 the limit is $69 674, which means the maximum GST credit for a car is $6 334 (1/11 of $69 674). For example, a car costing $91 315 used 100 % for business can only generate a GST credit of $6 334, whereas the credit would be $3 167 if the car were used 50 % for business. Exceptions apply for cars held as trading stock or used as emergency vehicles, allowing full GST credits.

Instant asset write‑off and depreciation

The Australian government periodically allows small businesses to claim an instant asset write‑off for depreciating assets. For the 2024–25 income year, businesses with aggregated turnover less than $10 million can deduct the full cost of eligible assets costing less than $20 000 if they are first used or installed ready for use between 1 July 2024 and 30 June 2025. The threshold applies per asset, so multiple assets costing less than $20 000 can each be written off. Assets costing more than $20 000 are added to the small‑business depreciation pool and depreciated at 15 % in the first year and 30 % thereafter. Vehicles may be eligible provided they cost less than the threshold and are used primarily for business. Businesses should check for updates, as the threshold and eligibility conditions are subject to annual budget changes.

Fringe Benefits Tax (FBT)

When a business provides a vehicle to an employee and that vehicle is available for private use, a car fringe benefit arises and the employer may need to pay FBT. The ATO states that FBT applies when an employer provides an employee with the use of a passenger vehicle (fewer than nine seats) or an eligible commercial vehicle. Private use includes garaging a car at home or using it for private trips; FBT does not apply to business use. A car fringe benefit can also arise when an employer leases a car for an employee under a novated lease, whereby the car is salary‑packaged. To be a bona fide lease, the arrangement must be at arm’s length, the residual value must reflect the car’s estimated market value at the end of the lease, and there must be no pre‑existing agreement for the employee to buy or continue using the car after the lease term.

FBT rules include several exemptions. Commercial vehicles used for limited private purposes may be exempt, and from 1 July 2022 eligible electric cars provided through novated leases are FBT‑exempt. Employers can use methods such as the statutory formula or the logbook method to calculate FBT liability. Businesses should keep detailed records of vehicle usage (logbooks) to substantiate business use and to claim appropriate deductions.

Registration, insurance and logbooks

When a vehicle is owned by a business, it should be registered in the business’s name using the ABN. Insurance policies should also reflect business ownership to ensure coverage. The SBDC recommends keeping a logbook to record business and personal use for at least 12 continuous weeks and to update it every five years or whenever the usage pattern changes. Accurate logbooks are crucial for substantiating GST credits, claiming motor‑vehicle expenses and reducing FBT.

Practical Considerations when Choosing a Vehicle and Loan

New vs used vehicles

Businesses must decide whether to purchase new or used vehicles. New vehicles generally come with warranties, are more fuel‑efficient and may have lower maintenance costs; however they cost more upfront and depreciation is steep in the first few years. Used vehicles cost less but may require more maintenance and may not meet the latest emissions or safety standards. Some lenders restrict the age of vehicles they will finance. For example, AGM Finance (a truck finance broker) typically requires at least one director to own property or contribute a 20 % deposit and imposes age limits on trucks; we have not cited this due to dynamic content but such policies are common. Buyers should verify that the vehicle is unencumbered and roadworthy, especially when buying from private sellers.

Choosing the right vehicle and accessories

The ATO allows businesses to finance a wide range of vehicles and equipment, provided the asset will be used primarily for business. AAA Finance lists eligible categories:

- Passenger vehicles: cars and utes for business owners and employees.

- Commercial vehicles: vans, trucks and delivery vehicles.

- Heavy machinery: earthmoving equipment, excavators and loaders.

- Factory and industry‑specific equipment: forklifts, cranes and production machinery.

Business‑related vehicle uses include travelling between job sites or client meetings, transporting equipment and tools, and operating mobile services such as cleaning, bookkeeping or personal training. Accessories and modifications such as ute canopies, tool drawers, roof racks, tow bars, safety modifications and custom fittings can also be financed.

Running costs and budgets

Finance is only one component of the total cost of owning a vehicle. Businesses should consider fuel, registration, insurance, maintenance, repairs, tyres and potential downtime. The SBDC encourages evaluating how often the vehicle will be used, the distance driven, whether it will carry heavy loads, and the impact on cash flow. Leasing or renting may be preferable if the vehicle will be replaced frequently or used seasonally.

Personal vs business purchase

The SBDC compares buying a vehicle under a business name versus a personal name. Business purchases can attract tax benefits, instant asset write‑offs and GST credits, but finance may be harder to obtain and consumer law protections may be limited. Personal purchases are easier to finance and qualify for consumer guarantees, but the owner cannot claim GST credits or the instant asset write‑off and may need to adjust FBT calculations if the vehicle is used for work. Businesses should weigh the trade‑off between tax advantages and consumer protections.

The Role of Finance Brokers

Finance brokers act as intermediaries between borrowers and lenders. They can simplify the application process, negotiate rates and terms, and advise on documentation. For small businesses that may not meet standard lending criteria, brokers are especially valuable because they have relationships with multiple lenders and understand each lender’s appetite for low‑doc or no‑doc loans.

AAA Finance emphasises that its brokers have access to over 40 different lenders and that they continuously monitor each lender’s requirements. By understanding the borrower’s business and matching it to appropriate lenders, brokers aim to obtain approval at the best possible terms. For truck loans, AAA Finance states that accessing an experienced finance broker is the easiest and most effective way to get a great deal. Brokers can also arrange pre‑approval to strengthen a buyer’s negotiating power.

When choosing a broker, businesses should ensure the broker holds an Australian Credit Licence or is an authorised credit representative. Fees may be paid by the lender or charged to the borrower; transparency around fees and commissions is important.

AAA Finance: Profile of a Specialist Lender and Broker

Company overview

AAA Finance and Insurance is a Queensland‑based finance brokerage operating from the Sunshine Coast. The firm positions itself as a “one‑stop shop” offering finance for cars, business vehicles, caravans, bikes, boats and personal loans. It emphasises fast approvals, tailored solutions and access to a large panel of lenders. The website’s tagline is “Finance made simple – fast, easy and tailored to you”, and the company claims to provide expert brokers who handle the paperwork and negotiate on the client’s behalf.

Business vehicle finance services

The Business Vehicle Finance section of AAA’s website provides a clear explanation of eligibility and loan options. Key points include:

- Eligibility criteria: Applicants must hold an ABN, use the vehicle primarily for business, provide some proof of income, be an Australian citizen or permanent resident and be over 18 years old. The vehicle must contribute to generating income for the business.

- Types of loans: AAA Finance offers no‑doc, low‑doc and full‑doc car loans. A no‑doc car loan requires an estimate of net turnover and gross profit and a signed declaration; the business must be GST‑registered and the borrower must own property. A low‑doc car loan requires BAS, profit and loss statements, bank statements and/or an accountant’s letter. A full‑doc car loan requires financial statements for companies or personal tax returns and Notices of Assessment for sole traders.

- Eligible vehicles and equipment: Business vehicle loans can finance passenger vehicles, utes, vans, trucks, heavy machinery, forklifts and factory equipment. Accessories such as ute canopies, tool drawers and roof racks may be included.

- Advantages: AAA Finance lists several advantages of business vehicle finance:

- Tax deductions and GST benefits. The GST on the purchase price, interest and the instant asset write‑off are claimable.

- Competitive interest rates. Business loans generally attract lower interest rates than consumer loans.

- Fixed monthly repayments. Direct debit repayments commence at the start of the loan so borrowers can set and forget.

- Balloon payment option. A lump sum due at the end of the loan reduces monthly repayments and frees up cash flow.

- Flexible loan terms (1–7 years).

- Loan calculator. The site includes a business car loan calculator where users input the loan amount, term and interest rate to estimate monthly repayments.

- Why choose AAA Finance? AAA highlights access to leading lenders, fast approvals, ability to structure loans for tax benefits and flexible repayment options. Brokers handle paperwork and can secure pre‑approval to empower buyers.

The FAQs emphasise that businesses can finance a vehicle under their ABN if the vehicle is used predominantly for business purposes. Business car finance works by financing the car under the business ABN, resulting in fixed monthly repayments with optional balloon payments. To obtain a business loan for a car, the applicant needs an active ABN and must justify that the car will be used for business‑related tasks; AAA Finance specialises in arranging such loans. The FAQ also confirms that a business can buy a car using an ABN if it operates as a sole trader, partnership, trust or company.

Truck finance services

The Truck Finance section of AAA Finance expands on the business vehicle offering:

- Purchase options: Finance is available for any type of truck—small, medium or heavy; flat, dump, tanker or refrigerated—and for trailers. The trucks can be new or used, purchased from a dealership or private seller and located anywhere in Australia.

- Loan types: The site describes no‑doc, low‑doc and full‑doc truck loans. A no‑doc truck loan requires signing an income declaration and meeting minimum requirements: GST registration, at least two years in business and directors who are asset‑backed. A low‑doc truck loan requires BAS, three months of bank statements, profit and loss statements and/or an accountant’s letter. A full‑doc truck loan requires up‑to‑date financials, including tax returns, profit and loss statements and possibly a balance sheet.

- Broker role: AAA emphasises that each lender has different requirements and its brokers understand these guidelines. They match borrowers with lenders based on individual circumstances, improving the likelihood of approval and securing favourable terms.

- Pre‑approval: Borrowers are encouraged to obtain pre‑approval, which specifies an amount of funds available for a particular asset and gives negotiating power.

- FAQs: The truck finance FAQs explain that using an experienced finance broker is the easiest way to obtain finance. Loan terms extend from 1 to 7 years. Interest rates depend on credit history, loan amount and the age and type of truck. A good monthly truck payment must fit within the business’s budget, ensuring adequate cash flow; repayment amounts are determined by purchase price, loan term and interest rate.

Competitive advantages

AAA Finance distinguishes itself through:

- Range of lenders. With access to over 40 lenders, AAA can cater to varied borrower profiles, including start‑ups and established businesses.

- Fast approvals. Many truck loans are approved within 24 hours, enabling businesses to act quickly when purchasing vehicles.

- Expertise in no‑doc and low‑doc loans. AAA offers specialised products for borrowers lacking full financials, requiring only income declarations and minimal documentation.

- Flexibility. Loan terms, repayment structures (including balloon payments) and financing for accessories help tailor finance to cash‑flow needs.

- Support with pre‑approval and negotiations. Pre‑approval helps clients stay within budget and gives them confidence during auctions or negotiations.

Given these strengths, AAA Finance is well positioned as a go‑to provider for small businesses seeking vehicle and truck finance.

Finally

Small‑business vehicle finance in Australia encompasses a wide range of products and considerations. No‑doc and low‑doc loans enable self‑employed people and small businesses to purchase cars and trucks without full financial statements. These loans usually require an ABN, proof that the vehicle will be used primarily for business and, depending on the lender, property ownership or a deposit. Loan terms typically range from one to seven years, and interest rates vary based on credit history, vehicle type and the amount borrowed. Borrowers should plan for a deposit, especially if they are new businesses, and budget for running costs and tax obligations.

| Loan Type | Ownership | Tax Benefits | GST Treatment | Best For |

|---|---|---|---|---|

| Chattel Mortgage | Business owns vehicle immediately | Depreciation & interest deductible | GST on purchase price claimable upfront | Businesses wanting ownership from day one and full tax benefits |

| Hire Purchase | Lender owns until final payment | Interest & depreciation deductible | GST claimable on purchase price (when financed) | Businesses preferring staged ownership with tax deductions |

| Finance Lease | Lender owns; business leases | Lease rentals deductible as operating expense | GST claimable on lease payments | Businesses wanting low upfront costs and no ownership obligations |

| Operating Lease/Rental | Lender owns; short-term rental | Lease/rental payments fully deductible | GST claimable on each rental payment | Businesses needing flexibility without long-term ownership |

| No-Doc / Low-Doc Loans | Business owns vehicle (like chattel) | Same as chattel mortgage, depending on structure | GST claimable if registered for GST | Sole traders/self-employed with minimal financial documentation |

Legal considerations include the fact that business‑purpose loans fall outside the National Credit Code, which means consumer protections are limited. Borrowers should only sign a business purpose declaration if the credit is truly for business use and should be aware that unscrupulous lenders may try to avoid compliance by misrepresenting the purpose of the loan. Nonetheless, lenders must still comply with other laws and avoid misleading conduct.

Tax implications are significant. Businesses can claim GST credits on vehicles used solely for business, subject to the car depreciation limit. The instant asset write‑off allows small businesses to immediately deduct the cost of eligible assets under $20 000. When vehicles are provided to employees for private use, FBT may apply, and logbooks should be maintained to substantiate business use.

Finance brokers play an important role in matching borrowers to lenders. Brokers have insight into different lenders’ criteria and can navigate low‑doc and no‑doc options, negotiate rates and arrange pre‑approvals. AAA Finance exemplifies how specialist brokers can simplify the process. With access to a large panel of lenders, expertise in no‑doc and low‑doc loans and services such as pre‑approval and loan calculators, AAA Finance provides tailored solutions for small‑business vehicle and truck finance. Their emphasis on tax benefits, flexible terms and rapid approvals positions them as a strong partner for Australian small businesses looking to expand their fleets.

By understanding the available loan structures, eligibility criteria, tax rules and legal considerations, and by partnering with experienced brokers like AAA Finance, small‑business owners can confidently acquire the vehicles they need to grow their enterprises.

References:

https://www.aaafinance.com.au/

https://www.lawhandbook.sa.gov.au/ch10s05s01s02.php

https://financialrights.org.au/factsheet/national-credit-act/

https://www.bizcover.com.au/bizwitty/understanding-car-financing-for-small-business-owners/

https://www.pattersoncheneytrucks.com.au/finance/

https://www.commbank.com.au/business/articles/types-of-finance-for-business.html

https://www.broker.com.au/low-doc-car-loans/

https://www.qpffinance.com.au/truck-finance/

https://www.asic.gov.au/for-finance-professionals/credit-licensees/do-you-need-a-credit-licence/faqs-does-the-credit-legislation-apply/

https://www.smallbusiness.wa.gov.au/blog/small-business-owners-guide-buying-vehicle

https://www.ato.gov.au/businesses-and-organisations/gst-excise-and-indirect-taxes/gst/in-detail/your-industry/motor-vehicle-and-transport/gst-and-motor-vehicles/purchasing-a-motor-vehicle

https://www.pattersoncheneytrucks.com.au/finance/