Are there government grants or support programs for small businesses in Australia?

Support for small businesses is plentiful in Australia, with a variety of government grants and programs designed to help you thrive. Understanding what is available can significantly enhance your opportunities for growth and sustainability. This guide will navigate you through the multitude of funding options and support initiatives that you can take advantage of, ensuring you make informed decisions for your business’s future.

Key Takeaways:

- Diverse Funding Options: Australia offers a variety of government grants and support programs tailored for small businesses, including financial assistance, mentorship, and resources for growth.

- Eligibility Criteria: Each program has specific eligibility requirements based on factors such as business size, industry, and location, making it crucial for small business owners to assess their qualifications carefully.

- Application Process: The application process for grants can be competitive and detailed, requiring businesses to provide thorough documentation and demonstrate how funding will benefit their operations.

Types of Government Grants for Small Businesses

Before exploring your options, it’s imperative to understand the types of government grants available for small businesses in Australia. Various grants cater to different needs and industries, including:

| Start-up Grants | Financial aid for new businesses to cover initial costs. |

| Innovation Grants | Support for businesses that focus on research and development. |

| Export Grants | Assistance for businesses looking to expand into international markets. |

| Training Grants | Funding for employee skill development and training programs. |

| Environmental Grants | Support for eco-friendly initiatives and sustainable practices. |

Knowing your specific business needs helps in identifying which grant may be most beneficial for you.

Federal Grants

There’s a variety of federal grants designed to assist small businesses across Australia. These grants, offered by different government departments, aim to foster innovation, support job creation, and boost economic activity. You can explore options like the Small Business Grants Hub or apply for specific funding programs tailored to your industry or business objectives.

State and Local Grants

Federal support is complemented by grants issued at the state and local levels. Each state in Australia provides unique funding initiatives and support services tailored to meet the specific needs of small businesses in that region.

Grants at the state and local levels often focus on economic development, local job creation, and community engagement. They may include financial support for small businesses involved in tourism, technology, or agriculture, reflecting the specific priorities of your state’s economy. By researching both federal and state/local grants, you can devise a comprehensive funding strategy to strengthen your business.

Support Programs for Small Businesses

Any small business owner in Australia can benefit from various support programs designed to enhance their growth and sustainability. These initiatives range from financial assistance and grants to resources that facilitate networking and skill development. Engaging in these programs can significantly empower you and elevate your business.

Financial Assistance Programs

Programs available for financial assistance often include grants, loans, and subsidies, aimed at helping you alleviate operational costs and invest in growth. These funding opportunities vary by state and industry, catering to your specific needs, whether it’s for startup costs, research and development, or expansion efforts.

Advisory and Mentorship Services

With advisory and mentorship services, you gain access to seasoned professionals who can provide guidance on strategic planning and best practices. These programs aim to enhance your skills and knowledge, positioning you for long-term success.

This support network typically includes one-on-one mentorship, group workshops, and access to valuable resources and tools. By participating, you can build connections with experienced industry leaders who can share insights and help you navigate challenges effectively. Ultimately, these services empower you to make informed decisions that propel your business forward.

Tips for Applying for Grants

To enhance your chances of securing a grant, pay attention to the following tips:

- Research thoroughly to identify the right grants for your business.

- Follow application guidelines meticulously.

- Provide clear and compelling information on how the funding will be used.

- Seek feedback on your application from mentors or colleagues.

The key to success is to ensure your application stands out.

Preparing Your Business Plan

If you want to apply for a grant, a well-crafted business plan is necessary. It should outline your business goals, strategies, and financial projections. This document demonstrates to grant committees that you have a clear vision and the capability to execute it effectively.

Meeting Eligibility Requirements

To qualify for most grants, you must meet specific eligibility criteria. These often include factors like your business size, location, industry, and purpose for the funding. Understanding these criteria is vital to tailor your application effectively.

Meeting the eligibility requirements may require you to provide documentation that substantiates your business status and intentions. You should review all guidelines carefully and ensure you can demonstrate how your business aligns with the specific goals of the grant program. This preparation can significantly improve your chances of success in obtaining the funding you seek.

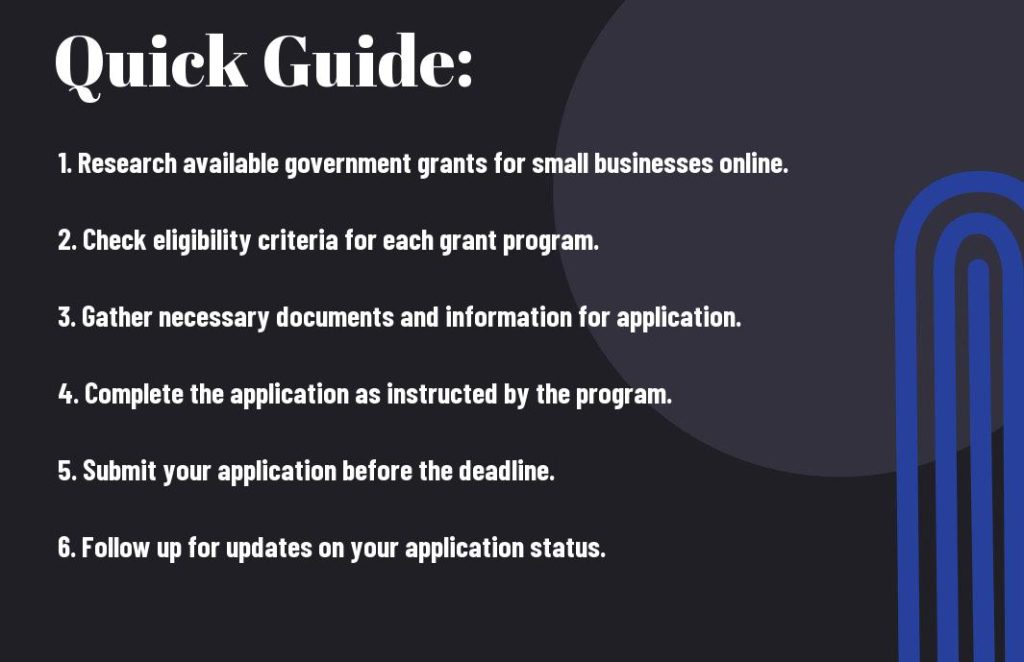

Step-by-Step Application Process

Not every application is the same, but a typical process involves clear stages to enhance your chances of securing funding. Here’s a straightforward breakdown:

| Step | Description |

|---|---|

| 1. Research | Identify relevant grants and eligibility criteria. |

| 2. Prepare | Gather necessary documentation and information. |

| 3. Apply | Submit your completed application form. |

| 4. Follow Up | Check the status and be available for any queries. |

Researching Available Grants

You will want to start by exploring various government and private grants that suit your business needs. Various websites provide searchable databases tailored for small businesses, making it easier for you to find appropriate funding options specific to your industry and location.

Submitting Your Application

Submitting your application requires careful attention to detail to ensure all required documentation is included. Be thorough in answering all questions and double-check to confirm that your information is accurate and complete.

Submitting an effective application can significantly influence your chances of receiving funding. Take the time to clarify your business goals, delineate how the funds will be used, and provide any additional supporting documents that highlight your business’s potential. Tailor your application to meet the grant’s specific criteria, enhancing your overall presentation and improving your prospects.

Factors to Consider

Despite the availability of various government grants and support programs, several factors should influence your decision. Evaluate the following:

- Your business type and size

- Eligibility requirements

- Funding amounts and budget

- Application process complexity

- Implementation timelines

This comprehensive evaluation will help you determine the most suitable options for your small business needs.

Understanding Your Business Needs

Business analysis is vital in identifying specific areas where support might be beneficial. Assess your operations, financial condition, and growth potential to pinpoint opportunities for improvement. Understanding what you need will help you select the most relevant grants that align with your objectives.

Evaluating Grant Terms and Conditions

To ensure that you select the best grant for your small business, it is important to evaluate the specific terms and conditions of each opportunity.

Consider factors such as the required reporting obligations, timeline for funding, restrictions on usage, and any conditions attached to the grant. Carefully reviewing these elements will help you avoid unexpected pitfalls and ensure a smoother process in meeting grant requirements while achieving your business goals.

Pros and Cons of Government Support

For any small business owner considering government grants and support programs, it is imperative to weigh the pros and cons. The following table outlines some benefits and drawbacks of accessing government support.

| Pros | Cons |

|---|---|

| Financial assistance to grow your business | Complex application processes |

| Access to valuable resources and training | Programs may have strict eligibility criteria |

| Networking opportunities with other businesses | Potential for increased scrutiny and reporting requirements |

| Support during challenging economic times | Lack of flexibility in how funds can be used |

| Encourages innovation and new projects | Limited funding availability in certain sectors |

Advantages of Grants and Programs

With government grants and support programs, you can receive vital funding that helps accelerate your business growth. They often come with added benefits like training and mentorship, equipping you with the tools and resources necessary for success. This assistance can be particularly beneficial during tough economic periods, providing much-needed relief and support.

Potential Drawbacks

There’s no denying that while government support has its advantages, it also presents certain challenges. You may face lengthy application processes and strict criteria, potentially making it difficult to access the funds you need. Additionally, the requirement for regular reporting can add to your administrative workload.

It’s important to thoroughly evaluate the aspects of government support. The complexity of applications and compliance may require you to invest time and resources that could otherwise be directed towards running your business. Furthermore, if your business operates in a dynamic industry, the rigidity of funding allocations can hinder your ability to adapt to changing market conditions.

Conclusion

With this in mind, understanding the various government grants and support programs available for small businesses in Australia can enhance your chances of success. By exploring options like the Small Business Grants Hub, state-specific initiatives, and support for innovation, you can access valuable resources to foster growth and sustainability. Keeping informed about the eligibility criteria and application processes will empower you to leverage these opportunities effectively, ultimately aiding your business in navigating the challenges ahead.

Q: Are there government grants available for small businesses in Australia?

A: Yes, there are various government grants available for small businesses in Australia. These grants typically target specific categories such as innovation, export, and job creation. The Australian government, along with state and territory governments, offers programs aimed at helping small businesses. Examples include the Entrepreneurs’ Programme, which provides advice, funding, and support for businesses to grow, and the Small Business Grants Hub, where you can find a range of grant opportunities that suit your business needs.

Q: How can I find information about support programs for my small business?

A: There are several resources available to find information on support programs for small businesses in Australia. The Australian Government’s Business website is a great starting point, offering information on grants, funding, and assistance programs. Additionally, the Business.gov.au platform provides useful tools and a grant finder to help businesses identify potential funding opportunities. Local chambers of commerce and industry associations also offer resources and guidance on navigating support programs tailored for businesses in specific regions or sectors.

Q: What types of support can I expect from government programs for small businesses?

A: Government programs for small businesses in Australia offer a variety of support types. This can include financial assistance in the form of grants or low-interest loans, advisory services to help with business planning and strategy, and training programs for skill development. Additionally, some programs may provide networking opportunities and access to resources that help businesses grow and succeed in their respective markets. Each program may have specific eligibility requirements and conditions, so it’s beneficial to thoroughly review each opportunity before applying.

Source article: https://smallbiztoolbox.com.au/32-are-there-government-grants-or-support-programs-for-small-businesses-in-australia/